Analyzing the Data

Late 2016, the first Extractive Sector Transparency Measures Act (ESTMA) reports were publicly filed in Canada, which for the first time gave the public access to data on project level royalty, tax, and other payments made by oil, gas, and mining companies to extract natural resources. With over 750 companies disclosing data, this represents an unprecedented opportunity to better understand revenues flows in the global extractive sector.

In response to this reporting,

PWYP Canada began to analyze several reports at the project level to better understand the project, corporate structure, and basis of reporting and to use the aggregate data to undertake several country/regional-level analyses.

Mini Case Studies by PWYP Canada

The below case studies explore project-level information disclosed by extractive companies. They seek to contextualize and further explain the company and the payments made in relation to one mine. They are a tool to promote and encourage the use of ESTMA data by journalists and civil society advocates.

Select Examples of Partners Using Data

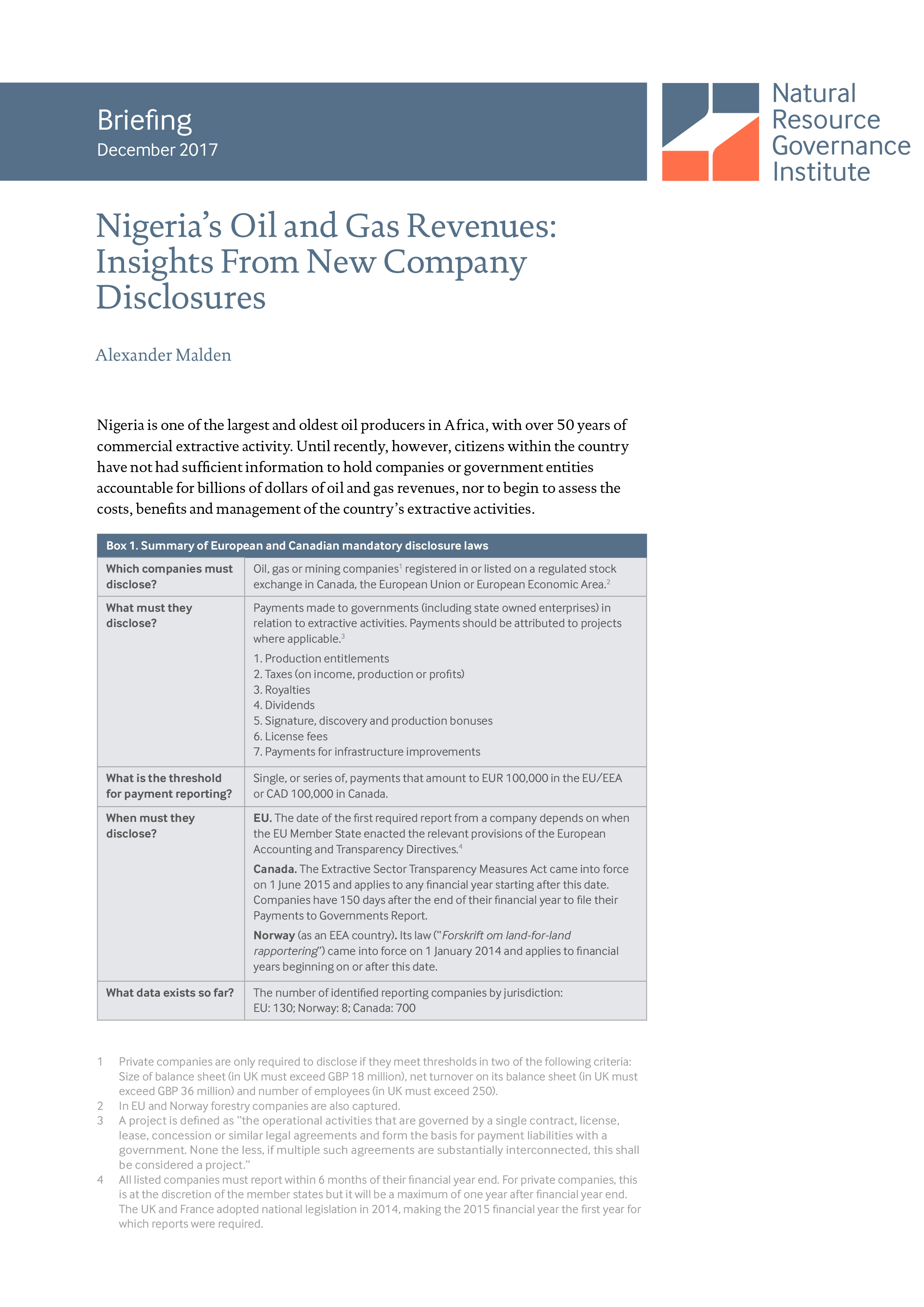

These examples show recent efforts by civil society and journalists to use data on what extractive companies are paying governments, including the data available through ESTMA. Examples include case studies and data portals which examine payments to governments in Ghana, Nigeria and Canada.

About This Data and How To Use It

To learn more about how governments lose extractives revenues and how you can use existing payment disclosures such as ESTMA to hold governments and industry to account, take a read through these reports.

Many Ways to Lose a Billion

PWYP Canada and PWYP report Many Ways to Lose a Billion explores the pathways to government revenue loss in the extractive sector, focusing on both protecting the tax rates, but also safeguarding the tax base.Finding the Missing Millions

Global Witness and Resources for Development Consulting guide Finding the Missing Millions: A handbook for using extractive companies’ revenue disclosures to hold governments and industry to account.

Where to Find This Data

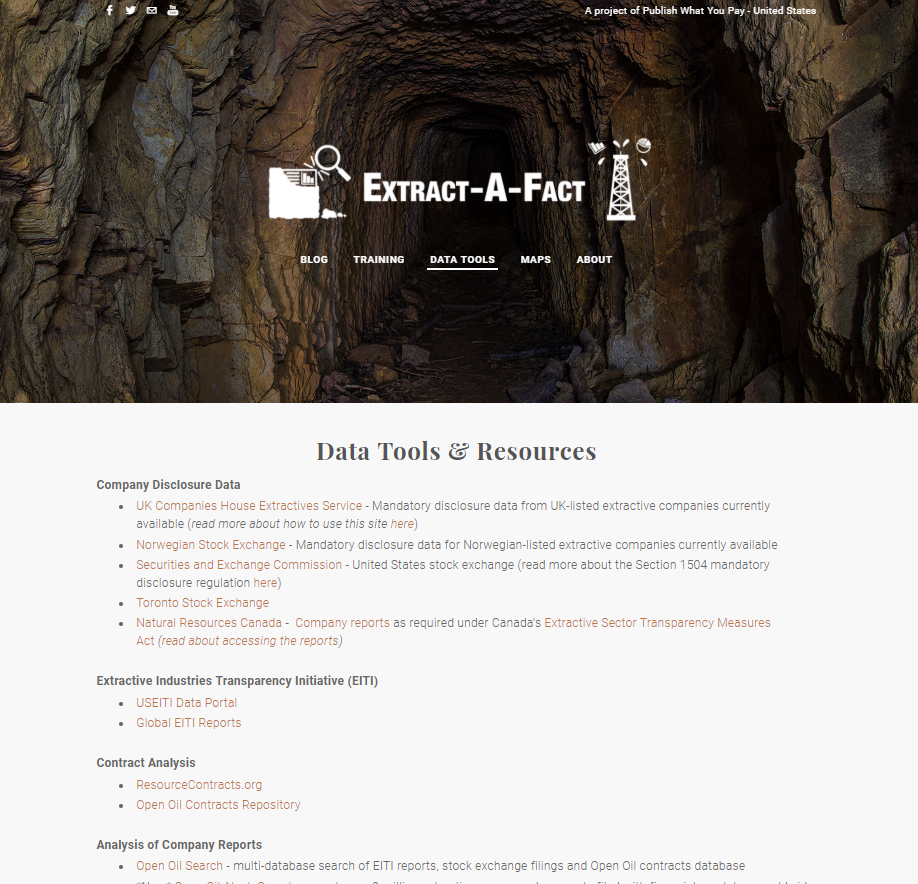

If you’re interested in using existing disclosures on payments that extractive companies are making to governments, explore the data below by company or search for specific governments or agencies.

>> Useful Websites to find information on what companies are paying governments

Central portal with global company mandatory revenue data disclosure (includes Canada, UK, EU, other)—allows for searching by country, company, government agency, payment type, etc.

Natural Resources Canada: Links to ESTMA Reports

Central portal with links to company ESTMA reports—allows for searching by company.

Extractive Industries Transparency Initiative

For EITI implementing countries, find information on what companies are paying governments. EITI reports include additional detailed information on the money that governments report receiving (so that these can be reconciled against what companies have paid), and other financial, social, and environmental disclosures. Note that the fiscal year that companies report may differ between the EITI report and mandatory payment to government disclosure data. This can contribute, for example, to a discrepancy between what a company reports paying a government in their ESTMA report and EITI report. To learn more about these differences, see PWYP UK’s research comparing these two data sets for the UK (download).

>> Other Useful Websites to find additional information on companies and projects

Central portal with mining, oil and gas company contracts.

Filings made by public Canadian mining companies (key files include Annual Information Forms and Technical Reports).

Business and Human Rights Resource Centre

Global business and human rights knowledge hub, delivering up-to-date and comprehensive news in eight languages.

>> Company Websites

Individual company websites offer generic company reporting such as annual reports, corporate social responsibility (CSR) reports, financial statements, and corporate presentations.

>> fiscal regime of a country

Mining and/or oil and gas codes include information on the fiscal regime of a country.